Social inequality is a poison that hinders the balanced growth of the country and makes Brazil easy prey to populist politicians, both from the left and right. Hence the need to urgently resume the policies to reduce inequality that began to be created after the 1988 Brazilian Constitution and gained momentum during the administrations of former presidents Fernando Henrique Cardoso (FHC) and Lula, associated with an articulated set of reforms that aims to increase the efficiency of the State and the productivity of the economy.

This was the take away from Armínio Fraga's lecture, which attracted a crowd of politicians, economists, social scientists, lawyers, businesspeople, and students, curious to hear what a former president of Brazil's Central Bank (under the FHC administration) would have to say about the topic of inequality. “This is not a subject to which I have dedicated myself more deeply during my career as an economist, but I have concluded that inequality is at the center of our problems and I have decided to study it a little while ago. I bring some concerns and suggestions, but I also want to hear you,” said Armínio at the beginning of his lecture.

“There is no reason to wait to tackle inequality. We must act immediately on several fronts because Brazilians, especially the poorest, will not support a reformist government if they don't feel that their lives are improving.”

Armínio Fraga, former president of Brazil's Central Bank (1999-2003)

Armínio is considered a liberal economist and, according to him, a certain degree of inequality is natural in societies and stimulates individual initiative and entrepreneurship. However, Brazilian society has persistent historical reasons for its inequality. “It originated in the exploitation colonialism and slavery installed in the country and was reinforced throughout our history by patrimonialism, State capture, the exclusionary character of several of our institutions, lack of focus on education and, more recently, growing market power (market concentration in the hands of one or a few companies),” said the lecturer, who has a Ph.D. in Economics from Princeton University.

Resume and deepen the course

Armed with charts that display different Gini index cuts - which measures the inequality of income distribution within countries and allows comparisons between them - and other data (see the Related Content section, on the right of this page), Armínio reminded the public that Brazil was on the right path in the 1990s and 2000s. “As of 1988, with the inclusion of social rights and objectives in Brazil's Constitution, things have begun to move in the right direction. Inflation control, an achievement of the Itamar Franco and Fernando Henrique Cardoso administrations, played an essential part in this, along with the search for macroeconomic balance. The Fernando Henrique Cardoso administration correctly focused on education and health and the beginning of State reform. The Lula administration continued some of these policies and deepened them, prioritizing the fight against poverty. We need to resume and deepen the course of such policies,” he said.

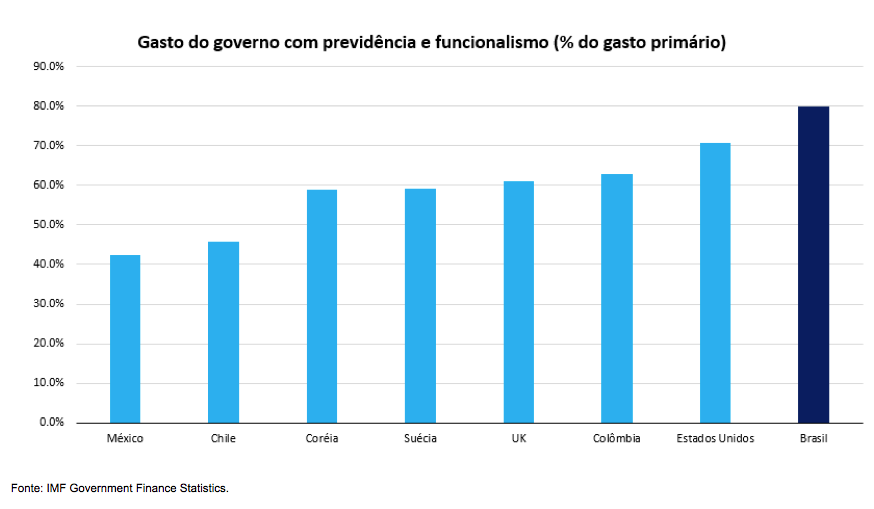

According to the economist, the country needs to reorganize itself to spend more and better in the social areas, without giving up the macroeconomic balance. “Brazil doesn't take adequate actions focusing on the long term, with effective equal opportunities policies, or on the short term, through the fair collection of taxes and income transfer directed to those who need it. We need to invest more in education, health, basic sanitation, public safety, and transport. For this to be possible, it is essential to spend less on the public payroll, pensions, and tax subsidies. Only then will we be able to direct our limited resources to the younger and the poorer,” he said.

Although he made it clear that he would not present a final proposal to tackle the problem of inequality, Armínio defended the Social Security and State reforms, the latter aimed at fighting patrimonialism, both articulated and based on social justice and efficiency. At the same time, he proposed to tackle the inequalities of the tax system immediately. “Reforms should not be made only for fiscal purposes, but rather to increase distributive justice and make the State more efficient, enabling it to offer better quality services. If people are not convinced that the reforms are headed in the right direction, they will not support them,” he added.

Among the various graphs presented, one shows that 80% of the government's primary spending goes to social security and public payroll (see below). “It's an extravagance that prevents the country from making necessary investments to improve the lives of its citizens,” he said.

Government spending on social security and public payroll (% of primary spending)

Countries: Mexico, Chile, South Korea, Sweden, UK, Colombia, United States, and Brazil

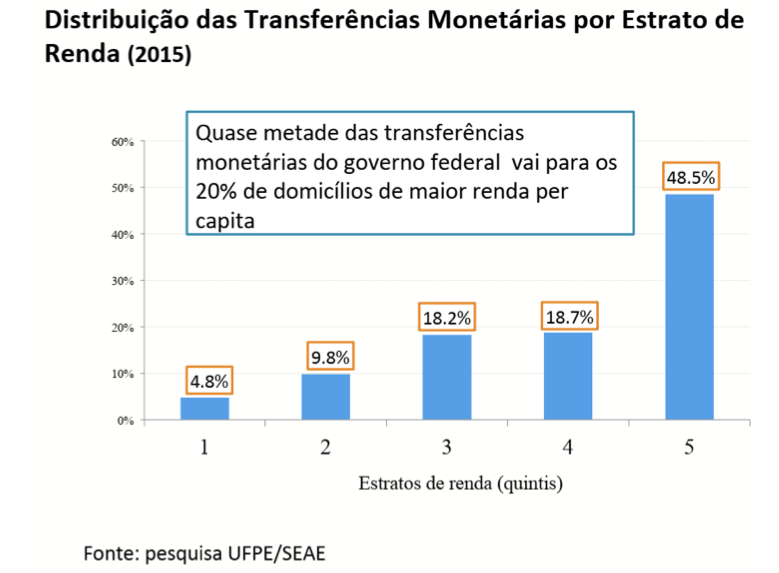

Another graph that caught the audience's attention showed that half of the money transfers made by the State ends up in the hands of the 20% highest-income households (see below).

Distribution of Monetary Transfers by Income Strata

Almost half of the federal government's money transfers go to the 20% highest-income households per capita.

Income strata (quintiles)

According to Armínio, indirect taxes are disproportionately charged from poorest people, who also pay very high-interest rates when they need to take out a loan. “Those who take out a 1,000 BRL loan pay a 40% annual interest. It just doesn't make sense,” he said.

Meanwhile, the wealthy benefit in many ways. One of them is the so-called 'pejotização' (hiring individuals as if they were legal entities), whereby professionals with gross sales of up to 4.8 million BRL may join the Simples Nacional Taxation System, paying lower taxes. The advantages are also significant in the financial market for those who have more resources. “In Brazil, those who have a lot of money to invest may create a fund and postpone the payment of taxes on capital income until when pigs fly,” said Armínio, who is also a founding partner of Gávea Investimentos - an investment management firm.

‘Renationalize the State’

The economist also criticized the subsidies granted by the State to various sectors of the economy and the Brazilian Development Bank (BNDES) loans with interest rates significantly lower than those practiced by the market. “Tax waivers amount to 5% of the country's GDP. If we cut it in half, the State will have more money to invest in social policies, thereby reducing inequality, and the economy will work better. It is necessary to “renationalize the State,” said Armínio.

In defending the need for tax reform, the speaker proposed, among other measures, the creation of a tax on gifts and inheritances, “today, the tax bracket on gifts and inheritances is less than 10%, but we could charge more.” On the other hand, he said that there was an excess of taxation on labor income, which increases the number of informal workers in the country. “It is important to review this situation but in an articulated way with the social security reform,” he said.

These reforms would take place amid a fiscal adjustment equivalent to at least 4% of Brazil's GDP. “Brazil needs to spend less and better to have the flexibility to make countercyclical policy in times of crisis. Countercyclical fiscal policy is for those who can, not for whoever wants it.”

For Armínio, with debt close to 80% of the GDP and growing, Brazil should make an even more significant fiscal adjustment. “When I was young, I weighed 75 kg. The years went by, and I gained weight and, next thing you know, I was 90 kg, always tired and with back pain. Getting things under control wasn't enough; I was forced to lose weight. For Brazil to return to good health and regain the capacity to invest in those who need it, the adjustment should reach something like 6% of the GDP,” he said.

Collective anesthesia

At the end of his presentation, Armínio reminded the audience that economists can help identify problems, but politicians, intellectuals and opinion makers, in general, need to help convince the population of the need to adopt a set of measures and reforms aimed at making the State healthier and more efficient, thus increasing its ability to reduce inequality. “It’is essential to make clear to the people that those who are gaining more than they should would be the biggest losers if the reforms are approved,” he said. Among them, the richest and the highest State officials.

“We are experiencing a phase of political-institutional paralysis and some collective anesthesia. To overcome it, it is essential to communicate better with the population, as well as to be transparent about other agendas that show that things will be distributionally managed. Only then will the government and parliament have what it takes to make the necessary changes,” he said.

“The issue is mainly political,” agreed former president Fernando Henrique Cardoso. “It is not easy to make changes that affect interests and the pocket of privileged groups. No one changes when they are buried in abundance, but in moments of crisis. It is essential to have a leadership that dialogs with the public opinion and harps on the same string every day until we can move forward with focus and consistency. It is no use trying to push the solutions to others,” concluded Cardoso.

Otávio Dias is a journalist specialized in politics and international affairs, former correspondent of Folha de S. Paulo in London, and editor of the website estadao.com.br. He is currently the content editor at FHC Foundation.

Portuguese to English translation by Melissa Harkin (Harkin Translations). Revised by Beatriz Kipnis.