“We are experiencing a period of complex interaction between the economy and politics. And when the economy weakens politics, or vice-versa, a whole range of unpleasant possibilities may emerge.”

Martin Wolf, chief economics commentator at the newspaper “Financial Times”

After facing the ‘Great Recession’, which began in the United States at the end of 2007 and spread over a large part of the planet in the following years, the world economy is finally stabilizing and GDP should grow in the majority of countries in the coming years, but not enough for the world as a whole to experience a longer period of sustained progress and well-being, as in the beginning of the 2000s.

In parallel, the global geopolitical order has become destabilized and fragile. Dominated economically and politically for several centuries by the West (first by Europe and later by the United States), the world is shifting rapidly towards a new reality in which Asia is becoming the most dynamic economic center and anti-globalization forces are gaining ground in the West.

“It is a new era of profound political and economic transformations, marked by major changes in power at a global level, declining economic dynamism, especially in the developed countries, a deceleration in globalization and in integration between countries and, evidently, growing nationalism, protectionism, authoritarianism and populism, both on the right and on the left, in the wealthy and in the developing countries. We are in the midst of this process, and we do not know where it will lead us”, said the British economic journalist Martin Wolf at the beginning of his talk at the Fundação Fernando Henrique Cardoso.

To illustrate his talk, divided into four parts, the associate editor of the “Financial Times” newspaper presented 21 charts, from which we have selected nine, which are commented on below.

1. Current conjuncture: major trends

“Asia is the new center (of the emerging world), all the rest is peripheral. And China knows this.”

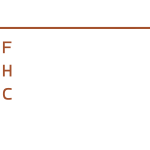

Chart 1: The Asian convergence

The chart above shows the evolution of the share of the USA, European Union (EU), China, India, other developed countries, other emerging Asian and non-Asian nations in World GDP, based on purchasing power parity, PPP, according to the IMF. “In the 1980s, the developed countries accounted for more than 60% of the World GDP, now they account for 40%. The EU and Japan suffered the largest decrease. The USA’s share also dropped, although not so acutely. At the same time, we have seen the explosive growth of China, South and Southeast Asia and, more recently, India”, Wolf explained.

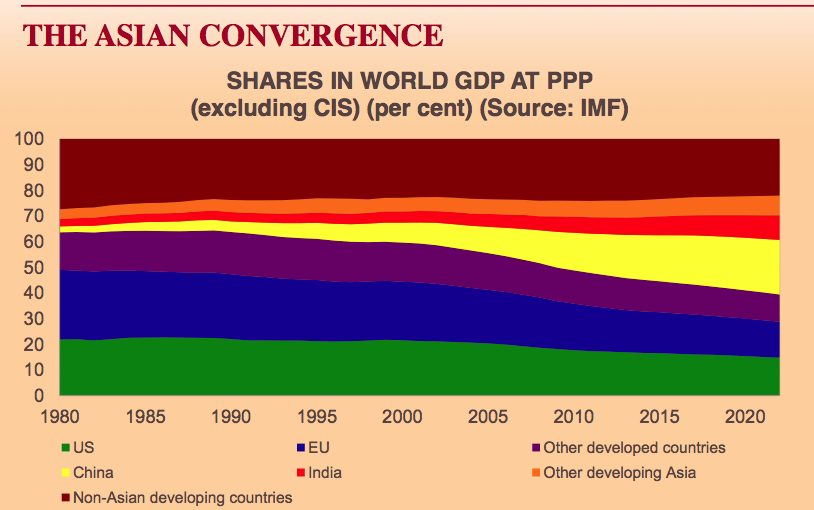

Chart 2: Evolution of GDP per head in six emerging countries and Russia compared with per head GDP in the USA between 1990 and 2022 (estimate)

According to Wolf, China and India represent “the great convergence” underway in Asia. Although they are still well behind, the trend towards the approximation of the two most highly populated countries in the world to America’s per capita GDP is clear and has been accelerating. Both started from a level of less than 5% of the North American per capita GDP in 1990, in the case of China increasing to more than 30% (in the coming years). India’s per capita GDP took longer to accelerate but will soon reach 15% of the American GDP and will continue to grow. In Russia, per capita GDP fell in comparison with the USA in the first years after the end of the Soviet Union (1991), accelerated between 2000 and 2015 (the increase in oil prices) and then dropped back to its 2008 level. Indonesia grew significantly in the 1990s, underwent a crisis, but is recovering. Turkey grew between 2000 and 2015 (the Erdoğan government’s most successful period), but is tending to stagnate. In Mexico, the ratio between the country’s per capita GDP and that of the USA has remained practically stable over the three decades. In Brazil, this ratio improved between 2005 and 2014 (the commodities boom), but has since worsened. “Brazil is the yellow line, it is possible to see clearly what is happening here”, the speaker said

2. Coming out of the Great Recession

“All the countries are on positive ground, but with modest growth. India is the only country in which expectations have not deteriorated, even China is growing less. But Asia, in general terms, confirms what we already know.”

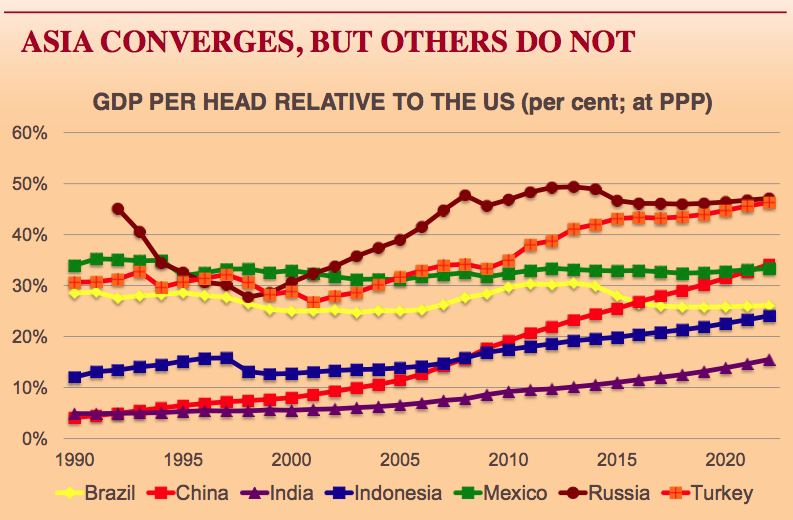

Chart 3: Recession and recovery

In 2007, the USA and the EU (average of the 27 member-states) had an equivalent per capita GDP. With the financial crisis, both retracted at similar levels in the two following years. From 2009, the USA initiated a recovery and in 2012 exceeded its pre-crisis level. Whereas the EU suffered another drop, driven by the “euro crisis” between 2010 and 2012, and only recuperated its pre-crisis level in 2016. “The recession is over (on both sides of the Atlantic), but the recovery has been slow”, he said.

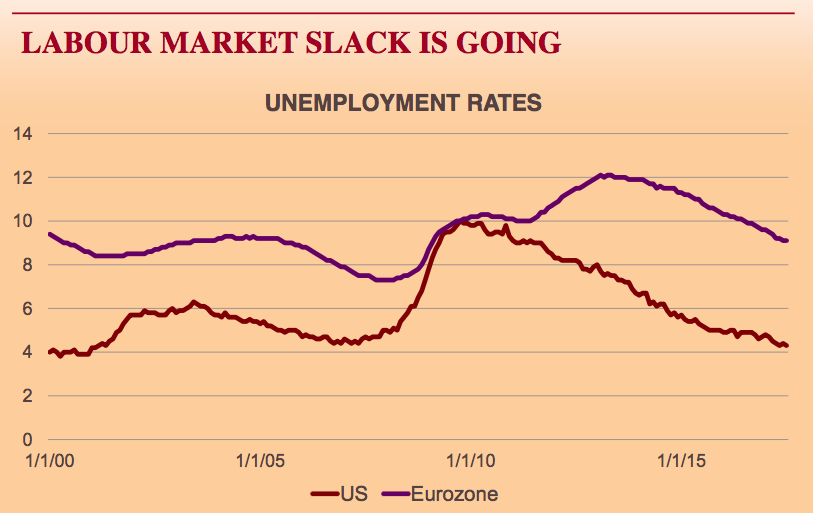

Chart 4: Evolution in unemployment

In the USA, unemployment was at just over 4% in 2007 (beginning of crisis), hit 10% in 2010 and has receded since then, returning to the level of 4%. In the EU, it was a little over 7% (average) in mid-2007. It reached 12% in 2013 and is now at around the 9% mark. “The USA is back to its pre-crisis level, but Europe still needs another three years”, he stated.

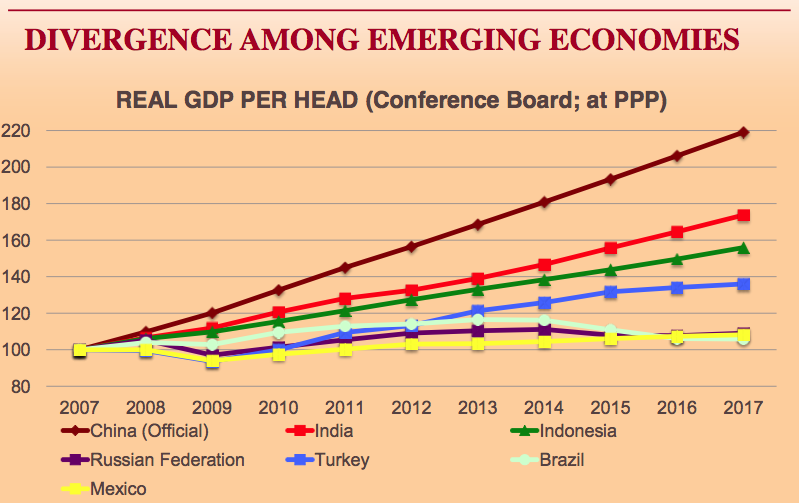

Chart 5: Divergence among the emerging economies

The evolution of per capita GDP (PPP) of the six main emerging countries and Russia since 2007 shows China’s great advance, followed by that of India and Indonesia. Brazil was in fourth position in 2010, but then lost ground to Turkey and in 2017 is in last place. Russia had an upward oscillation but then returned to its initial level. Mexico remained stable. “It is clearly a success story in Asia. In China, it is as if the global recession had never happened and the country did not depend on the economic growth of the industrialized countries. It is without doubt a ‘new animal’ in the world economy”, said the analyst.

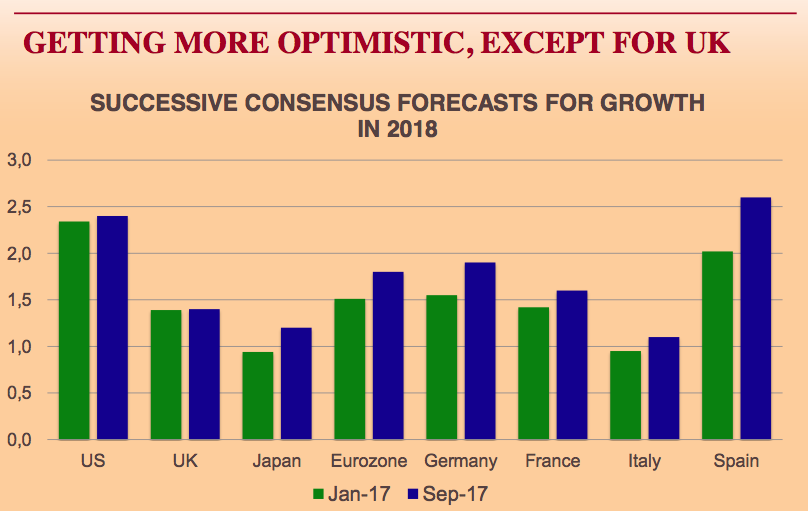

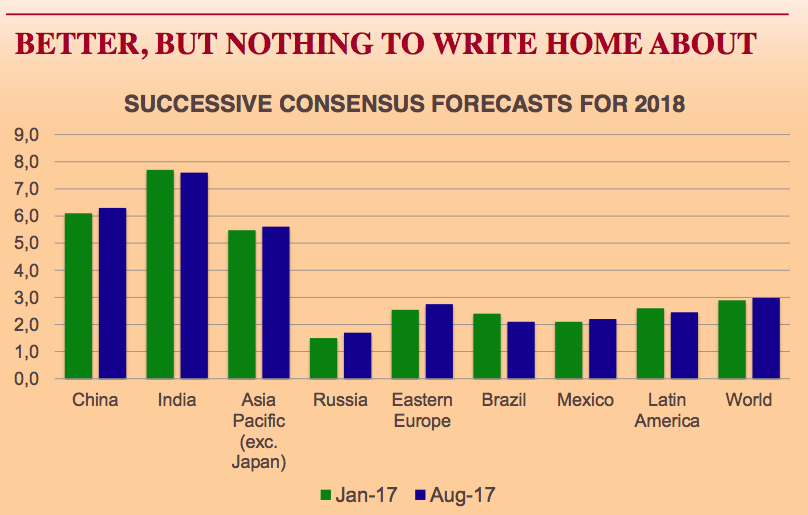

Charts 6 and 7: Current GDP growth in the developed and emerging countries

The first chart above shows that growth expectations in the USA, in the EU and in some European countries individually and in Japan are over 1%, worthy of note being GDP in North America (almost 2.5%) and in Spain (just over 2.5%, if the Catalonia crisis does not spoil everything). Whereas among the emerging countries, India is in the lead (almost 8%), followed by China (6%) and other Asian countries (5.5%). “Between 2017 and 2018, Brazil will come out of recession and should grow at around 2%, a little below the world average of approximately 3%. Russia is in last place”, he said.

3. Economic concerns

“The world is experiencing a period of inflation below the targets set by the majority of the countries and consumer demand is low. However, if prices begin to rise in the USA and the US Federal Reserve decides to increase interest rates significantly, most countries will probably follow suit and will see an increase in debt, which could provoke a return to global recession. This hypothesis is rather unlikely, but is possible.”

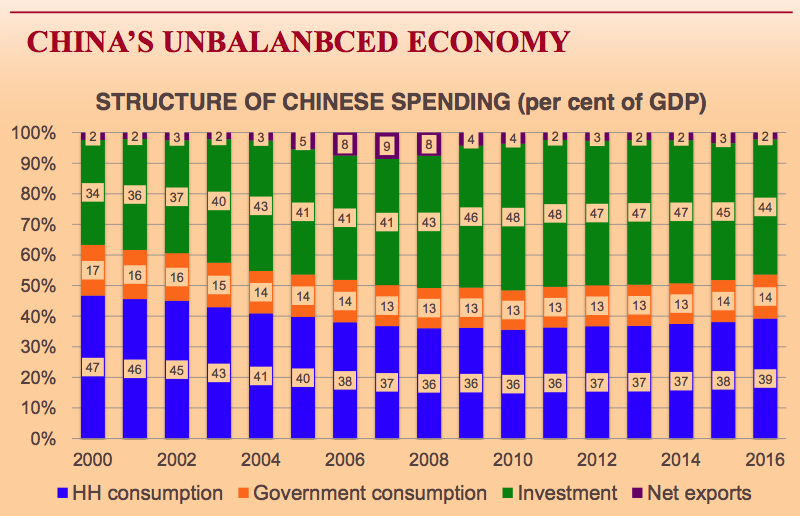

Chart 8: The imbalance in the Chinese economy

For the speaker, however, the main macroeconomic issue of the moment is the structural imbalance in the Chinese economy, evolution of which is presented in the chart above. “In 2000, China was growing at 10% per year and the structure of public and private spending and investments was more balanced. Then the crisis broke out and the Chinese trade surplus (exports less imports) dropped from 9% (2007) to 2% (2016), leading the government to execute one of the biggest ever “investment booms”. The negative side is that there has been an enormous increase in credit and, consequently, in indebtedness. Will the government be able to reverse this situation and avoid a debt crisis? It is possible, but it should take around ten years, and today the world depends on China’s economic (and political) stability”, he said.

Wolf also compared public investment and household spending in the Asian country with Brazil. “The structure of spending in the Chinese economy is the mirror image (inverted) of Brazil. Brazil invests very little and saves very little (household consumption is 60% of GDP). In China, it is the opposite. The middle course would be better: you should be more like them and they should be more like you”, he stated.

4. Political concerns

“20 years ago it was not like this, but today the entire international system depends on the stability of relations between the incumbent (mainly the USA) and the emerging powers (China).”

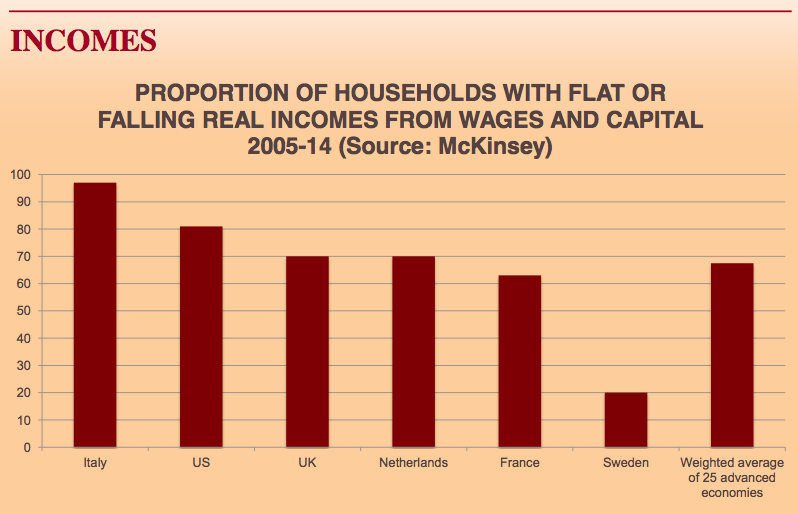

Chart 9: Flat or falling income

The chart above shows that between 2005 and 2014, family income remained flat in the majority of the advanced economies, which for Wolf is one of the reasons for the strengthening of populist parties and/or leaders in Europe and the USA. “Between 60% and 100% of families saw their income remain flat or decrease, something that had not happened since the end of the Second World War. It was a lost decade, and people are angry because they think this is happening due to the incompetence of their elites, mainly the bankers, and to corruption. The United Kingdom’s decision to leave the EU (Brexit), Donald Trump’s victory and the results of recent elections in Europe (even though the political center ended up winning in France and Germany) are examples of the current crisis in Western democracies and the growth in populism, phenomena which will not disappear rapidly”, the British journalist declared.

The future relationship between the USA and China is also at the center of political risks. “The possibility that misunderstandings will end in conflict is high because the two most important countries on the planet have different viewpoints on nearly everything in the world, including North Korea, whose leap forward as a nuclear power is the most serious issue in the world at the moment”, he stated.

Martin Wolf’s complete presentation (in PowerPoint) is available in the section Conteúdos Relacionados (this page, on the right).

Further information:

Inovações disruptivas e o futuro do emprego: ameaças e oportunidades

Para onde vai a Europa? Por José Manuel Durão Barroso

Democracias turbulentas: o que acontece nos EUA, na Europa e na América Latina

Watch Diálogo na Web “2017 à vista: uma nova (des)ordem mundial”, with the journalists Patrícia Campos Mello and Jaime Spitzcovsky.

Otávio Dias is a journalist specialized in international affairs. He was the correspondent for the Folha in London, editor of estadão.com.br and chief editor of Brasil Post, a partnership between the Huffington Post and the Abril Group.